Robert Douglas Hartmann pleaded guilty to bank and mail fraud charges stemming from his now defunct real-estate firm DHP Investments, U.S. Attorney Catherine Hanaway announced today.

Hartmann's DHP Investments was once involved in the rehab of hundreds of homes and buildings in the metro area -- particularly in parts of south St. Louis. The firm went belly-up in late 2005 leaving dozens of investors in the lurch and pockmarking the city with scores of ramshackle projects tied up with clouded and disputed titles.

Hartmann faces a possible 24 months in prison at his June sentencing and up to $1.25 million in fines.

In his guilty plea, Hartmann admitted to a scheme in which he provided false vouchers and invoices to banks in order to draw down funds from construction loans that were made for the renovation or "rehab" of specific properties. The construction loan funds were then diverted by Hartmann to other projects and many of the rehabs never reached completion.

Hartmann also admitted that, by 2004, his business rarely generated true profits through property sales and that he needed constant sources of fresh funds from new investors and banks in order to pay off banks and investors as obligations came due. The U.S. Attorney doesn't say it, but that formula sounds a lot like a pyramid scheme to me.

The release today from the U.S. Attorney's office mentions two or three specific acts of fraud committed by Hartmann. But there were more. In 2006, I wrote how Hartmann and his business associate Lisa Krempasky deceived dozens of investors, including several local banks. You can view that article here, and continue on to read Hartmann's entire guilty plea.

April 2, 2009

For Immediate Release

LOCAL DEVELOPER PLEADS GUILTY TO MULTIPLE FRAUD CHARGES IN REAL ESTATE SCHEME

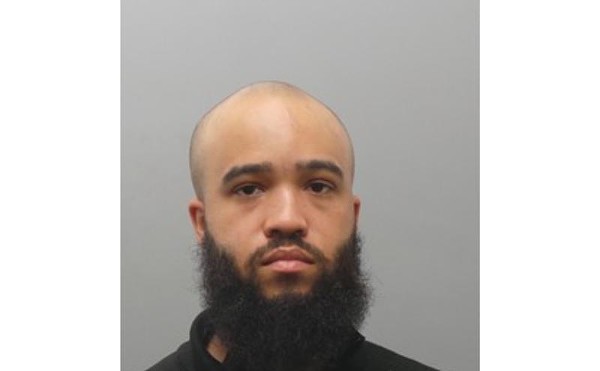

St. Louis, Missouri: Robert Douglas Hartmann pleaded guilty to bank and mail fraud charges stemming from his multi-million dollar real estate business, United States Attorney Catherine L. Hanaway announced today.

Hartmann was engaged in the purchasing, leasing, renovation, development and sales of real estate, and focused on existing properties that were in various stages of neglect or disrepair. He marketed the projects to associates and investors as redevelopment projects for sales, rental properties or as condominium development projects.

By the time his business collapsed in late 2005, Hartmann, 46, O'Fallon, MO, had been involved with hundreds of residential properties, many of them in south St. Louis City. He was charged with criminal offenses after investors, "hard money" lenders and banks were left with unfinished properties that were often dilapidated and, in many instances, went into foreclosure.

"Real estate developers like Hartmann have to know that they will face jail terms when they defraud investors and banks in their projects," said Hanaway. "The problems only become worse when the criminal acts like Hartmann's leave neighborhoods with boarded up homes and foreclosure signs. Hartmann's criminal conduct even cost a woman her house and her $44,000 equity. We will continue to investigate and prosecute developers who abuse the process in this way."

According to court documents, Hartmann can face up to 24 months in federal prison if the court accepts the parties' agreement. The guilty plea was made before U.S. District Judge Henry Autrey in St. Louis and sentencing was set for June 23, 2009.

Hartmann plead guilty to charges involving real estate transactions which generated losses of up to $400,000. He admitted to defrauding a woman of approximately $44,000 in equity in her home on the 1000 block of Jefferson Street in St. Charles by arranging a sale in early February, 2005, in which he, as the buyer, ended up receiving a check in excess of $44,000. Although the woman was the actual seller, Hartmann set up the deal in such a way that she received only $1,882.93. While claiming to help her keep her house which had some $56,000 in loans against it, Hartmann saddled the house with a mortgage up to its full value of $100,000 and, under the agreement, the woman made increased monthly payments to Hartmann of $1,108 in a rent-to-own arrangement. Within months of the sale, Hartmann caused additional deeds of trust for hard money loans totaling $68,000 to be placed against the house on Jefferson. She had no knowledge of the $100,000 bank loan nor of the hard money loans which left the house with $168,000 in deeds of trust against it--well beyond the fair market value of the house. Hartmann stopped making payments on the mortgage in November, 2005, but she kept making monthly payments to him well into 2006. As a result of Hartmann's failure to make the mortgage payments, the bank later foreclosed on the house and she was forced to leave, having lost her house and all the equity in it. Hartmann kept the $44,000 and the hard money loans for use in his business.

Hartmann also admitted to a scheme in which he provided false vouchers and invoices to banks in order to draw down funds from construction loans that were made for the renovation or "rehab" of specific properties. The construction loan funds were diverted by Hartmann to other projects and many of the rehabs never reached completion. Hartmann admitted that, by 2004, his business rarely generated true profits through property sales and that he needed constant sources of fresh funds from new investors and banks in order to pay off banks and investors as obligations came due.

In one bank fraud charge, Hartmann admitted that he failed to renovate a residence at 2715 Michigan in St. Louis after construction loans had been made by both Frontenac Bank as well as the Business Bank. Court documents show that construction loans in the amounts of $88,000 and $50,000, respectively, were made on that property. As part of his scheme, Hartmann admitted that a check for $3,500 in construction loan funds advanced for flooring on the Michigan property was, in fact, signed over by him to one of the hard money lenders.

The bank fraud charge relating to the Michigan property carries a maximum penalty of 30 years in prison and/or fines up to $1,000,000. The mail fraud charge relating to the house in St. Charles carries a maximum m penalty of 20 years in prison and/or fines up to $250,000. All sentences are governed in part by the federal sentencing guidelines and, pursuant to those guidelines, the parties agreed that a maximum prison term of 24 months could be imposed here. Hartmann will ask the court for a lesser sentence.

Last November, U.S. Attorney Hanaway convened the first meeting of the U.S. Attorney's Mortgage Fraud Task Force. The task force consists of over 70 residents of the Eastern District of Missouri involved in banking, mortgage brokerage, real estate sales, title insurance, real estate appraising as well as federal, state, and local law enforcement, regulatory officials and non-government organizations. Anyone wishing to report suspected mortgage fraud or participate in the work of the task force is encouraged to call the Mortgage Fraud hotline at 1-866-587-9571.

Hanaway commended the work on the case by the U.S. Postal Inspection Service, HUD- Office of Inspector General, the Federal Bureau of Investigation; and Assistant United States Attorneys James E. Crowe, Jr., Reginald Harris and Howard Marcus, who are handling the case for the U.S. Attorney's Office.

South City Real Estate Swinder Pleads Guilty to Fraud

[

{

"name": "GPT - Leaderboard - Inline - Content",

"component": "41932919",

"insertPoint": "5th",

"startingPoint": "3",

"requiredCountToDisplay": "3",

"maxInsertions": 100

}

]