All of Your Missouri Recreational Marijuana Questions Answered

By Riverfront Times on Thu, Nov 17, 2022 at 4:15 pm

Now that Amendment 3 has passed, Missourians have a lot of questions about legal recreational marijuana. Here are all of the answers you could need, our stoned friends.

Tags:

Scroll down to view images

Page 1 of 3

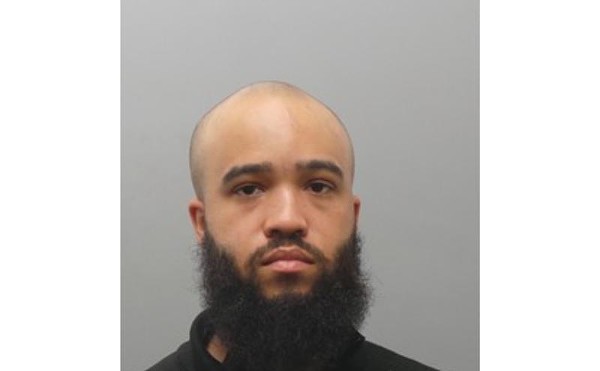

TOMMY CHIMS

Amendment 3, the initiative legalizing recreational use of marijuana, won 53% of the vote in Tuesday's midterm.

1 of 42

More info: Amendment 3 bars the state from requiring consumers to provide identification to dispensaries to prove anything other than their age.

3 of 42

4 of 42

5 of 42

More info: If you’re caught possessing or smoking weed underage, you could get a $100 fine or you might have the option to attend four hours of drug counseling instead.

6 of 42

7 of 42

8 of 42

More info: Current medical marijuana dispensaries will start applying for a license to sell recreational weed when Amendment 3 takes effect on December 8. The Department of Health and Senior Services will then have up to 60 days to take action on their applications, so sometime between early December and February, dispensaries will likely start selling marijuana to non-medical customers.

9 of 42

10 of 42

11 of 42

More info: Dispensaries will not have to differentiate between non-medical and medical marijuana, so there’s no telling whether marijuana purchased for medical reasons will cost more or less than recreational marijuana. However, medical marijuana will be taxed slightly less than recreational marijuana. Medical marijuana will keep its current 4 percent tax, while recreational marijuana will have a tax of at least 6 percent.

12 of 42

13 of 42

14 of 42

More info: Taxes on marijuana products in Illinois are based on their potency and can range from 10 percent to 25 percent of purchase prices. In Missouri, recreational marijuana taxes will be 6 percent of a product’s retail price. Locales will have the option to levy an additional local sales tax of 3 percent.

15 of 42

16 of 42

17 of 42

More info: You can buy, possess, consume, inhale, process and transport up to three ounces of dried, unprocessed marijuana or an equivalent.

18 of 42

19 of 42

20 of 42

Page 1 of 3

- Local St. Louis

- News

- Things to Do

- Arts & Culture

- Food & Drink

- Music

- Movies

- St. Louis in Pictures

- About Riverfront Times

- About Us

- Advertise

- Contact Us

- Jobs

- Big Lou Holdings, LLC

- Cincinnati CityBeat

- Louisville Leo Weekly

- Detroit Metro Times

- St. Louis Riverfront Times

- Sauce Magazine